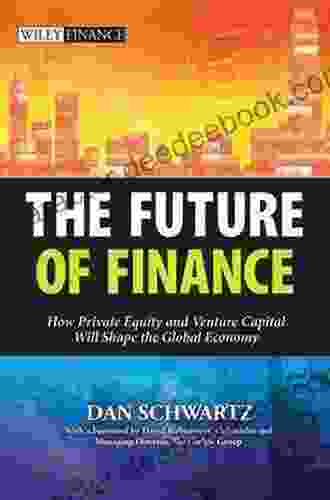

How Private Equity and Venture Capital Will Shape the Global Economy: A Comprehensive Guide

Private equity and venture capital are two important sources of capital for businesses, but they can also have a significant impact on the global economy. This article will explore the role of private equity and venture capital in shaping the global economy, and discuss the risks and opportunities that these investments present.

What are private equity and venture capital?

Private equity and venture capital are two types of investment that provide capital to businesses. Private equity is typically invested in mature businesses that are not publicly traded, while venture capital is typically invested in early-stage businesses that have high growth potential.

4.5 out of 5

| Language | : | English |

| File size | : | 3213 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 235 pages |

| Lending | : | Enabled |

Private equity and venture capital firms typically invest in businesses for a period of time, and then sell their stake in the business for a profit. The profit that these firms make is known as a "carry." The carry is typically a percentage of the profits that the business makes, and is paid to the private equity or venture capital firm over a period of time.

How do private equity and venture capital shape the global economy?

Private equity and venture capital can shape the global economy in a number of ways. First, these investments can provide capital to businesses that would not otherwise have access to capital. This can help businesses to grow and create jobs, which can boost the economy.

Second, private equity and venture capital can help to drive innovation. These investments can provide capital to businesses that are developing new technologies and products, which can lead to new industries and new jobs.

Third, private equity and venture capital can help to improve the efficiency of businesses. These investments can provide capital to businesses that are looking to improve their operations or expand into new markets. This can help businesses to become more profitable, which can boost the economy.

What are the risks and opportunities of investing in private equity and venture capital?

Investing in private equity and venture capital can be a risky proposition. These investments are typically illiquid, which means that investors cannot easily sell their stake in a business. Additionally, these investments can be volatile, which means that the value of the investment can fluctuate significantly over time.

However, investing in private equity and venture capital can also present opportunities for significant returns. These investments can provide investors with access to businesses that have high growth potential. Additionally, these investments can provide investors with a diversified portfolio, which can help to reduce risk.

Private equity and venture capital are two important sources of capital for businesses, and they can also have a significant impact on the global economy. These investments can provide capital to businesses that would not otherwise have access to capital, help to drive innovation, and improve the efficiency of businesses. However, investing in private equity and venture capital can also be a risky proposition. These investments are typically illiquid and volatile, and there is no guarantee that investors will make a profit. Nevertheless, investing in private equity and venture capital can present opportunities for significant returns, and these investments can be a valuable addition to a diversified portfolio.

4.5 out of 5

| Language | : | English |

| File size | : | 3213 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 235 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Reader

Reader Library

Library Paperback

Paperback Bibliography

Bibliography Foreword

Foreword Annotation

Annotation Manuscript

Manuscript Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Thesaurus

Thesaurus Character

Character Resolution

Resolution Catalog

Catalog Borrowing

Borrowing Stacks

Stacks Archives

Archives Periodicals

Periodicals Study

Study Scholarly

Scholarly Reserve

Reserve Rare Books

Rare Books Special Collections

Special Collections Literacy

Literacy Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Reading List

Reading List Book Club

Book Club Textbooks

Textbooks David Dvorkin

David Dvorkin Andrew Monaghan

Andrew Monaghan William Wilberforce

William Wilberforce Neal Simon

Neal Simon Heather Land

Heather Land Mai Der Vang

Mai Der Vang Pat O Bryan

Pat O Bryan Srimati Basu

Srimati Basu D V Lindley

D V Lindley Rachel Williams

Rachel Williams American Quilt Study Group

American Quilt Study Group Joseph Lumpkin

Joseph Lumpkin Susan Keefe

Susan Keefe Lainey Cullen Mcconkey

Lainey Cullen Mcconkey Stanley Ritchie

Stanley Ritchie Rajagopal

Rajagopal Rafe Blaufarb

Rafe Blaufarb Bailey Baxter

Bailey Baxter J K Henry

J K Henry K Arnhart

K Arnhart

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jimmy Butler100 Unforgettable Experiences in the City of Angels: 100 Things to Do in Los...

Jimmy Butler100 Unforgettable Experiences in the City of Angels: 100 Things to Do in Los...

Ralph Waldo EmersonThe Sins Left By My Father: Unraveling the Tangled Threads of Generational...

Ralph Waldo EmersonThe Sins Left By My Father: Unraveling the Tangled Threads of Generational... Wayne CarterFollow ·18.9k

Wayne CarterFollow ·18.9k Sidney CoxFollow ·14.5k

Sidney CoxFollow ·14.5k Douglas AdamsFollow ·11.4k

Douglas AdamsFollow ·11.4k Charlie ScottFollow ·15.9k

Charlie ScottFollow ·15.9k Michael CrichtonFollow ·14.9k

Michael CrichtonFollow ·14.9k Matt ReedFollow ·7.3k

Matt ReedFollow ·7.3k Austin FordFollow ·19.4k

Austin FordFollow ·19.4k Theo CoxFollow ·4.8k

Theo CoxFollow ·4.8k

Ronald Simmons

Ronald SimmonsHow Do Cities Work? Let's Read and Find Out!

Cities are...

Tom Clancy

Tom Clancy25th European Symposium on Research in Computer Security...

<p>Guildford,...

Lawrence Bell

Lawrence BellHow We Decide: Cognitive Behavior in Organizations and...

Organizations are...

E.M. Forster

E.M. ForsterOver 60 Little Masterpieces To Stitch And Wear:...

Embark on a Creative...

Douglas Foster

Douglas FosterUnveiling the Educational Treasure: CGP KS2 Geography:...

In the ever-evolving educational...

4.5 out of 5

| Language | : | English |

| File size | : | 3213 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 235 pages |

| Lending | : | Enabled |